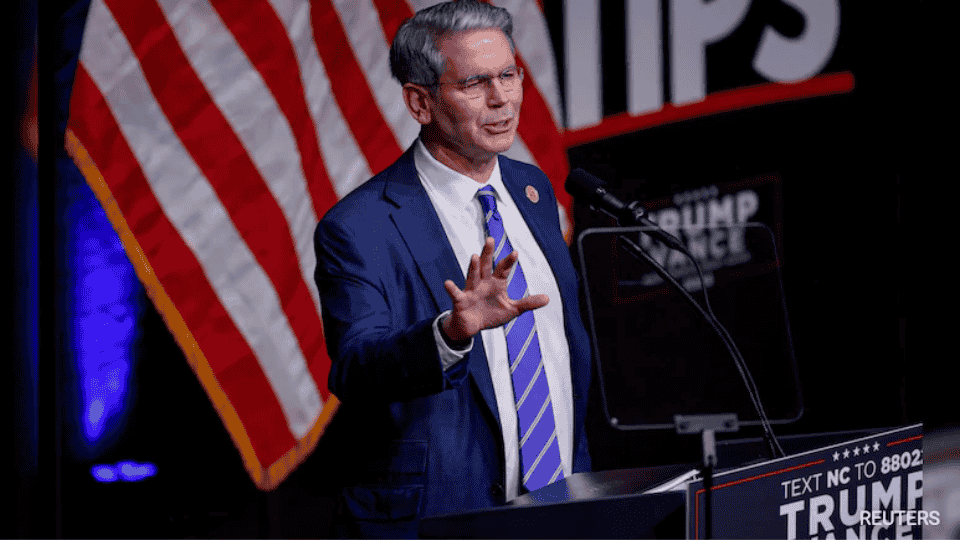

Scott Bessent US Treasury: President-elect Donald Trump’s newly appointed Treasury chief, hedge fund manager Scott Bessent, faces an uphill battle as he prepares to implement Trump’s economic vision. From addressing the debt ceiling to balancing tax cuts with fiscal sustainability, the challenges ahead are both urgent and complex.

Economic Agenda: Balancing Protectionism and Trade Stability

A central task for Bessent will be navigating the delicate balance between Trump’s push for protectionist trade policies and avoiding a global trade war.

- Tariff Policies: Trump has promised across-the-board tariffs of at least 10% on imports, with steeper levies targeting China. Bessent must ensure these policies foster negotiations with trade partners without sparking inflation or harming the economy.

- Role in Policy: Bessent’s approach—whether as a “cheerleader” for aggressive tariffs or a “moderating force”—will shape the administration’s economic direction, according to David Wessel, a senior fellow at Brookings.

Managing the Debt Ceiling: A Critical Priority

The Treasury will face immediate pressure to navigate the debt ceiling, which limits government borrowing to pay existing bills.

- Deadline Approaching: The debt ceiling suspension expires in January, requiring urgent measures to prevent the U.S. from defaulting on its obligations.

- Political Negotiations: While Republicans control the White House and Congress, concessions may be demanded during negotiations to raise the ceiling.

- Historical Context: Shai Akabas from the Bipartisan Policy Center notes that this will be the first modern instance of a debt ceiling debate occurring during a change in administration.

Tax Cuts: Delivering Relief Amid Fiscal Challenges

Tax relief is likely to be a cornerstone of Trump’s budget, set to be unveiled in early 2025.

- Campaign Promises: Plans include tax cuts for households and businesses, reduced taxes on tips, and potential increases in energy spending.

- Sustainability Concerns: The Treasury must balance these initiatives while maintaining a sustainable debt trajectory. “It’s going to be a very delicate job,” says EY chief economist Gregory Daco.

Rising Interest Costs and Debt Concerns

Trump’s proposed policies could add approximately $8 trillion to the national debt, according to the Committee for a Responsible Federal Budget.

- Debt at Historic Levels: Public debt currently stands at $28.6 trillion, nearly 100% of GDP, and is growing unsustainably.

- Potential Consequences:

- Higher interest rates on U.S. and consumer debt.

- Credit rating downgrades.

- Financial market instability.

- Global Impact: Shai Akabas warns that eroding faith in the U.S. as an economic leader could harm long-term growth prospects.

Stay Updated on the Latest Education News

To stay informed about the latest updates in education, board exams, college admissions, and study abroad opportunities, follow us regularly.